Volunteer Corner.

Get ready for VITA Latino by using the resources on this page.

Start here!

Explore the resources, learn what you need to volunteer, and watch the walkthrough video to get started.

Welcome to Our Volunteer Team!

Thank you for joining us! Your time, energy, and compassion help us ensure that Spanish-speaking families in Charlotte have the same opportunities to build financial stability and hope for the future.

Through programs like VITA Latino, you are not just preparing taxes or assisting with forms—you are empowering individuals, reducing barriers, and strengthening our entire community. Every smile, every answered question, and every moment of care make a lasting impact.

We are grateful for your commitment, and we are excited to work alongside you. Together, we are building a stronger, more financially capable Charlotte—one family at a time.

Training and Certification

While Buenas Finanzas Carolinas safeguards client information and provides community context, local logistics, and ongoing support, all certification materials — including tax law training, required readings, practice tools, and certification exams — are provided directly by the IRS. The certification process is individual and self-directed.

Certifications

Most volunteer roles require IRS certification, but some—such as Buenas Finanzas Ambassador and Interpreter—focus on community support rather than tax preparation. These positions are perfect for volunteers who want to get involved while learning about the program or before starting the certification process.

To begin certification, review the test instructions in Publication 6744. If you don’t pass on the first try, you can study the material and take the exam again.

Use this checklist to see which activities or exams you need for each role. You can print it if helpful.

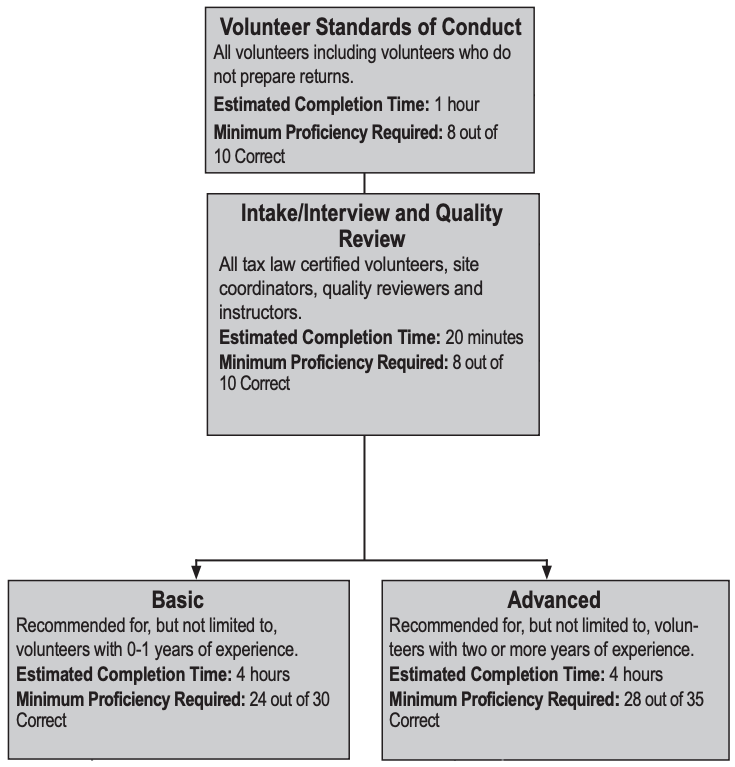

IRS training structure and estimated time commitment (from form 6744):

VITA Latino 2026 Orientation

Virtual Volunteer Orientation:

Recorded on December 15, 2025.

Volunteer Orientation presentation

VITA Latino Volunteer Preparation (upcoming)

Sessions are scheduled for January, 2026.

The three volunteer preparation meetings will cover the following themes:

What to Expect in a Tax Clinic:

An overview of the VITA Latino site experience, client flow, roles, and common scenarios.Self-Employment and Multi-State Tax Preparation:

Guidance on preparing returns for self-employed taxpayers and handling tax situations involving multiple states.Scams, Misinformation, and Potential Fraud:

Misinformation related to ACA, 1095-A form, dependents and inmigration status, undocumented status and IRS disclosure acts.

Training materials and certification are provided by the IRS.

To study: Use form 4961. Download 2025 version here.

Exam: Log in to your Link and Certificate account. Find the exam questions in form 6744. To get started with Link and Certificate, use this reference guide.

IRS Volunteer Standards of Conduct (VSC)

Training materials and certification are provided by the IRS.

To study: Use Publication 5101. Download 2025 version here.

Exam: Log in to your Link and Certificate account. Find the exam questions in form 6744.

IRS Intake/interview & Quality Review Certification

IRS Tax Law Certification

Training materials and certification are provided by the IRS.

To study: Use form 4491. Download 2025 version here. The same information can be found in Link and Learn taxes.

Exam: Pick the exam based on the certification you need, Basic or Advanced. Log in to your Link and Certificate account. Find the exam questions in form 6744.

Practice Lab:

Practice Lab, the training environment of TaxSlayer (the software used to prepare taxes), is used to complete practice and exam scenarios.

The detailed instructions can be found at the bottom of the Link and Learn website, in short:

Practice lab link https://vita.taxslayerpro.com/IRSTraining

On the access page, use the universal password “TRAINPROWEB”

Create an account for training purposes.

Turn off pop-up blockers to view the training.

How to approach the certification process

Important: Before taking the exam, make sure to review the IRS alerts, where you’ll find key information about the season, including corrections and updates to the forms.

Click here to find them.

The training materials can feel long and detailed, but there’s a simpler way to study: start by reviewing the certification questions in Publication 6744 and use the IRS reference publications to look up the answers. If you’re using a PDF, the “Find” function is an easy way to search for key terms and navigate the material quickly.

-

Online Resources: Visit www.vitaresources.net for IRS study guides, practice exercises, and reference materials.

Take advantage of their practice exam “Check & Learn”—an online version of the certification questions that isn’t connected to the IRS. It’s a risk-free way to practice the actual questions and build confidence. Direct links: Basic Check & Learn, Advance Check & Learn.

Thank you for sharing your time, energy, and talent with us. We’re honored to have you on our team and look forward to the positive difference you’ll make.

— Yuly V. Rodriguez. Director, Buenas Finanzas Carolinas

-

We’re here to support you every step of the way—before, during, and after tax season.

At the end of each season, we host a Volunteer Appreciation Event to celebrate your impact, share program results, and present a Certificate of Participation. In November, we also hold a Pre-Season Gathering to reconnect, exchange experiences, and welcome new volunteers to the team.

As part of your experience, you can also request a Letter of Acknowledgment recognizing your volunteer service—perfect for school, professional, or community engagement purposes.

-

Volunteers who hold professional credentials — such as Enrolled Agents (EA), Certified Public Accountants (CPA), or Annual Filing Season Program participants (AFSP) — may be eligible to receive Continuing Education (CE) credits for their volunteer service through the IRS.

The IRS awards CE credits for qualifying training and volunteer hours completed under the VITA/TCE program. For details, see the IRS Publication 5362, Continuing Education Credits for VITA/TCE Volunteers.Important: The “Professional Status” tab area in Link and Certificate must be completed to receive the credits.

-

Core Skills Developed

· Communication and client service

· Confidentiality and professionalism

· Accuracy and attention to detail

· Teamwork and time management

· Basic financial and tax literacy

· Computer and data-entry proficiency

Suggested Resume Phrases

Interpreter / Translator

· Supported bilingual communication between clients and tax preparers.

· Ensured accurate and confidential translation of financial information and forms.

Intake & Interview Specialist

· Reviewed client documents for completeness and eligibility.

· Conducted intake interviews following IRS quality standards and program guidelines.

Tax Preparer

· Completed individual tax returns using IRS TaxSlayer software under VITA guidelines.

· Applied federal and state tax laws to real cases while maintaining client confidentiality.

· Earned IRS certification as a Volunteer Tax Preparer.